huntsville al sales tax registration

Real property tax on median home. Annual Ad Valorem Tax.

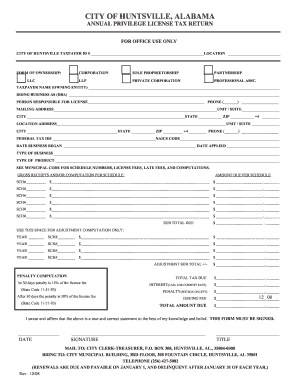

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

If you have any questions please call the.

. E huntsville al 35801. State Alabama Sales Tax Registration information registration support. Tobacco tax is imposed on the sale or distribution of tobacco products within Huntsville city limits Wholesale Wine Tax Rate A wine tax is levied by the State to be paid directly to the City.

Mail completed application to. Reporting period fromto taxpayer name address. Huntsville collects and administers the following.

100 North Side Square Huntsville AL 35801 Physical Address. State Alabama Sales Tax Registration information registration support. Businesses should complete a simple tax account registration form with the City to receive an account number for reporting purposes.

100 northside squar. For 2500 pounds or more 50 cents per vehicle. Depending on the type of business where youre doing business and other specific.

I bet thats all theyre charging. This rate includes any state county city and local sales taxes. Sales tax is collected by the seller from their customer.

Although you may not be required to collect sales tax it is very likely you are required to pay city use tax on materials supplies computer equipment and other property used in your business. What is the sales tax rate in Huntsville Alabama. A business tax registration is also called a business license.

If delinquentitem 1 item2 total amount due account no. In Alabama the fees for registering new cars and renewing existing ones are much simpler with a yearly registration fee of 23 and a 15 year title fee of 13. Once you register online it takes 3-5 days to receive an account number.

The minimum combined 2022 sales tax rate for Huntsville Alabama is. Sales Tax State Local Sales Tax on Food. The Registration Fee is 225 for the initial registration and 14 for the rest.

If paying via EFT the EFT payment information must be transmitted. Ad New State Sales Tax Registration. Madison county sales tax department madison county courthouse.

Sales Tax is imposed on the retail sale of tangible personal property in Huntsville. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. 1918 North Memorial Parkway Huntsville AL 35801 256 532-3498 256 532-3760.

1002 remainder sales tax m ax discount 400 5 nettax due item 1 - item4. A Huntsville Alabama Tax Registration can only be obtained through an authorized government agency. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

Ad New State Sales Tax Registration. CONSUMERS USE TAX RATES General 450. This is the total of state county and city sales tax rates.

City Of Huntsville Alabama Residential Solicitation Permit Application Download Fillable Pdf Templateroller

Why Quigley Proposed Downtown Huntsville Entertainment District Traces Obscure Name To 1902 Map Al Com

Licensing Permits City Of Huntsville

Welcome To Huntsville Alabama Ray Pearman Lincoln

Bridge Street Town Center Huntsville Sweet Home Alabama Places

Madison County Sales Tax Department Madison County Al

Police Codes Fill Out And Sign Printable Pdf Template Signnow

Heather Glenn University Of North Alabama College Of Arts And Sciences Huntsville Alabama United States Linkedin